child tax credit payments continue in 2022

That money will come at one time when 2022 taxes are filed in the spring of 2023. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Ad File to Get Your Child Tax Credits. Loss of child tax credit could send.

Parents and their children rally at the US. That means the child tax credit returns to a 2000 lump sum for individuals making up to 200000 and couples filing jointly who make up to 400000 with 1400. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The 2021 advance was 50 of your child tax credit with the rest on the next years return. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Within those returns are families who qualified for child tax credits CTC worth up to 3600 per child but you can still receive up to 2000 per child for 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Capitol in December 2021 to urge an extension of the expanded Child Tax Credit which expired on Jan. Claim the Tax Refund You Deserve.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. That 2000 child tax credit is also due to expire after 2025.

Will Monthly Child Tax Credit Payments Be Renewed In 2022 Kiplinger

Do Child Tax Credit Payments Stop When Child Turns 18 The Us Sun

Do Child Tax Credit Payments Stop When Child Turns 18 The Us Sun

Questions And Answers The New Expanded Child Tax Credit Ctc Washingtonlawhelp Org Helpful Information About The Law In Washington

The Advance Child Tax Credit 2022 And Beyond

The Advance Child Tax Credit 2022 And Beyond

Child Tax Credit Monthly Payments To Begin Soon The New York Times

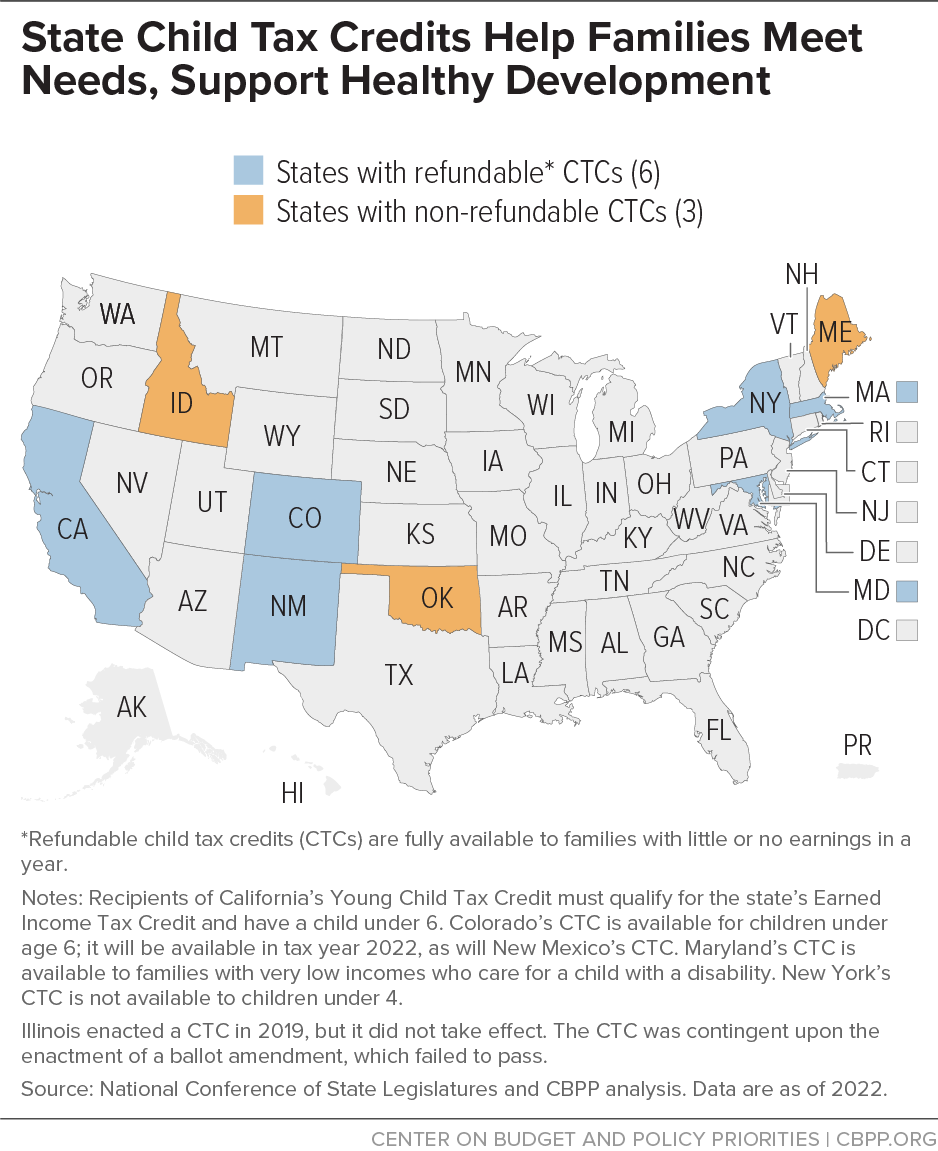

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Irs Tax Letters 2022 What Do The Letters Expected To Arrive Soon Mean For You Marca

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

Stop Child Support From Taking The Tax Refund In 2022 Faqs

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Do Child Tax Credit Payments Stop When Child Turns 18 The Us Sun

Expanded Child Tax Credit Senator Bernie Sanders

Child Tax Credit Ctc Get Your Payment Il

The Advance Child Tax Credit 2022 And Beyond

Child Tax Credit 2022 These 14 States Offer Their Own Child Tax Credit